Coinbase Pressure Mounts as Interest-Bearing Stablecoins Reach Key Decision Week

Original Title: Coinbase raises pressure as crypto bill moves to Senate markup

Original Authors: Emily Mason, Olga Kharif and Lydia Beyoud, Bloomberg

Translation: Peggy, BlockBeats

Editor's Note: As cryptocurrency regulation in the United States is gradually taking shape, the stablecoin "reward mechanism" has become a new focal point of controversy. Coinbase has warned that if Congress restricts platforms from offering stablecoin rewards to users in the upcoming market structure bill under consideration, it may withdraw its support for the bill.

On the surface, this is a dispute over a business incentive rule; in essence, it affects the boundary of interests between the crypto platform and the traditional banking system. The banking industry is concerned that stablecoin rewards could drain deposits, weakening the credit base; while platforms like Coinbase believe that this mechanism is related to the scale of stablecoins, the network effect of the US dollar, and industry competition fairness.

The following is the original text:

Coinbase's CEO Brian Armstrong

Coinbase Global Inc. is increasing pressure on U.S. lawmakers in an attempt to retain its ability to provide rewards to customers holding stablecoins. The company believes that if certain restrictions currently under discussion are included in a significant cryptocurrency bill expected to be released on Monday, this business will be at risk.

According to a person familiar with the company's thinking, if the bill text includes anything beyond "strengthened disclosure of reward-related information," the largest U.S. crypto exchange may reconsider whether to continue supporting the digital asset market structure bill. The bill is expected to enter the markup stage in at least one Senate committee on Thursday.

Coinbase did not respond to a request for comment.

Industry sources said that one option under consideration is to limit eligibility for rewards to regulated financial institutions. This approach has some support from the banking industry, as they believe that interest-bearing stablecoin accounts could "siphon off" deposits from the traditional banking system. Coinbase has applied for a national trust charter, which, if approved, could allow it to continue offering such rewards under the above rules. However, crypto-native companies are pushing to retain the "platform reward" model without a license and have warned that broader restrictions could disrupt the industry's competitive landscape.

The threat of "Support Withdrawal" is not insignificant. The cryptocurrency industry is the top industry in terms of corporate political spending during the 2023-2024 election cycle, funneling significant funds to favored candidates. Coinbase, led by co-founder and CEO Brian Armstrong, donated $1 million to Donald Trump's presidential inauguration and was also one of the companies funding the construction of a dining hall at the White House.

For Coinbase, the issue of incentives is crucial. The exchange shares part of the interest income generated from Circle Internet Group Inc.'s ref="/wiki/article/usd-coin-usdc-269">USDC stablecoin reserves with Circle. The USDC held on the Coinbase platform provides a stable source of income, especially crucial during bear markets. Coinbase also holds a small amount of Circle's stock; Circle is currently the largest compliant stablecoin issuer under a U.S. law passed in July.

For instance, Coinbase incentivizes users to hold USDC on the platform by offering a 3.5% reward for USDC in Coinbase One accounts. If market structure legislation prohibits such incentive measures, the stablecoin holdings on the platform may decrease, affecting Coinbase's overall stablecoin revenue. According to Bloomberg data, this revenue is expected to reach $1.3 billion by 2025.

Of course, the devil is in the details, and the impact is not yet fully clear, depending on the specific wording of the legislation. However, sources familiar with the matter have indicated that the legislation will include relevant references to incentives.

《GENIUS Act》

The second Trump administration swiftly brought a "positive" development to the digital asset industry, including the first federal-level stablecoin issuance regulatory framework passed in July, known as the "GENIUS Act." Following the signing of this act, a series of announcements from retailers to traditional financial institutions expressing intent to enter the stablecoin space have emerged. Even before the act officially became law, World Liberty Financial, co-founded by members of the Trump family, had already launched a proprietary stablecoin called USD1.

Despite government support to expedite the legislation, the "Stablecoin Reward" issue is eroding the bipartisan consensus of the market structure bill. Coinbase's warning of possible support withdrawal indicates that the escalating tension may slow down the legislative process and even result in the legislation not being completed this year. Bloomberg Intelligence analyst Nathan Dean suggests that if there is a lack of bipartisan support during the deliberation stage, the probability of passing relevant legislation in the first half of this year may drop to below 70%.

The "GENIUS Act" prohibits stablecoin issuers from paying users any form of interest or earnings solely for holding the token, but does not prohibit third-party distribution partners like Coinbase from offering rewards based on customer balances.

The banking industry strongly opposes exchanges providing stablecoin rewards, arguing that it would erode deposit sizes in the banking system and undermine community lending capacity.

The American Bankers Association wrote in a recent letter: "If billions of dollars are drawn away from community bank lending, small businesses, farmers, students, and homebuyers in towns like ours will be impacted. Cryptocurrency exchanges and their affiliated stablecoin firms are not designed to fill this lending gap and cannot offer FDIC-insured products, but they often conveniently omit this fact in their aggressive marketing."

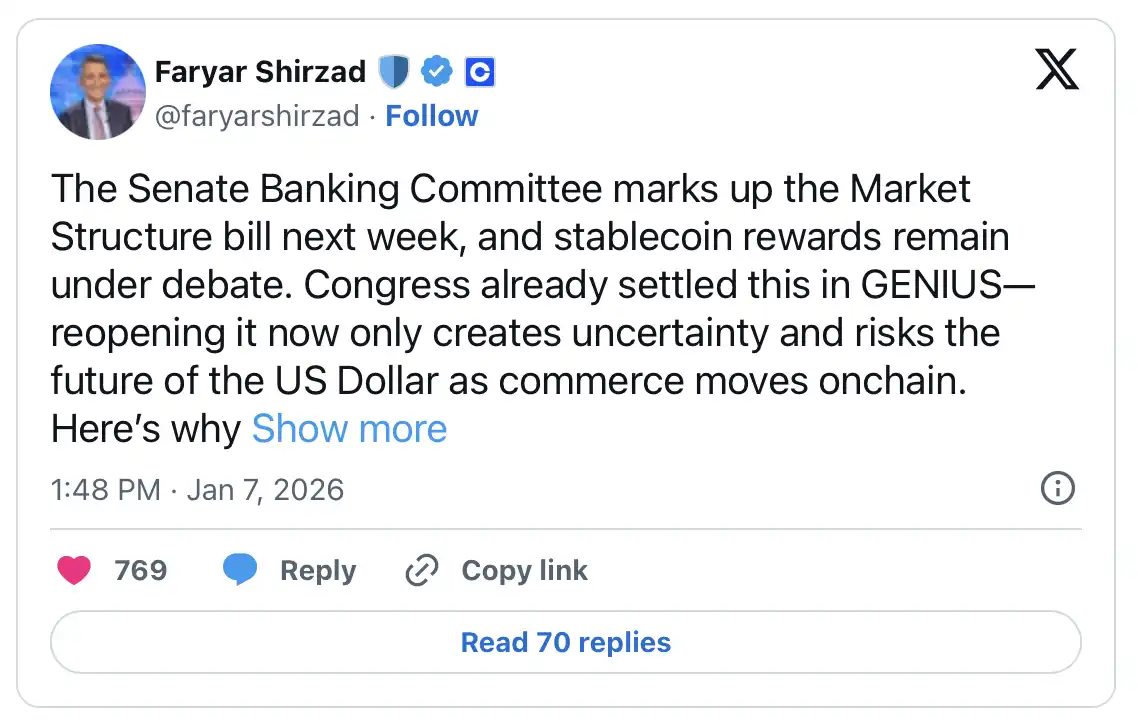

In contrast, the crypto industry portrays the banking sector's efforts as an attempt to overturn the consensus already reached in the "GENIUS Act." Coinbase's Chief Policy Officer Faryar Shirzad recently wrote on the X platform, emphasizing the importance of maintaining a reward mechanism linked to stablecoins to uphold the dollar's dominance. He also noted that China has recently announced plans to start paying interest on its central bank digital currency, the digital yuan.

This tension has put senators in a dilemma. Industry insiders and observers indicate that on one hand, the government is pushing for more legislation; on the other hand, they are forced to make a choice on an almost uncompromising issue.

Insiders suggest a possible middle ground: allowing only entities holding a banking charter or financial institutions to offer rewards to users based on stablecoin balances. The Office of the Comptroller of the Currency (OCC) recently conditionally approved five cryptocurrency companies to become national trust banks. However, these approvals have faced strong opposition from banking lobbying groups, which believe that cryptocurrency companies are stretching the boundaries of the "limited-purpose trust charter" and may pose a threat to the stability of the U.S. financial system. Given the existing approval precedents, allowing chartered companies to provide yield if included in the market structure bill may appease some participants in the crypto industry.

Nevertheless, some industry insiders believe that even if restrictions are imposed, it will only trigger a game of "whack-a-mole" – crypto firms will constantly seek new ways to reward users.

Payment giant Stripe's President of Technology and Business, William Gaybrick, stated in an interview last year: "There is no world where we can't reward consumers within an app. In a scenario where you hold stablecoin within an app, that app will always find some way to reward your behavior."

You may also like

Who's at the CFTC Table? A Rebalancing of American Fintech Discourse

AI Trading vs Human Crypto Traders: $10,000 Live Trading Battle Results in Munich, Germany (WEEX Hackathon 2026)

Discover how AI trading outperformed human traders in WEEX's live Munich showdown. Learn 3 key strategies from the battle and why AI is changing crypto trading.

Elon Musk's X Money vs. Crypto's Synthetic Dollars: Who Wins the Future of Money?

How do Synthetic Dollars work? This guide explains their strategies, benefits over traditional stablecoins like USDT, and risks every crypto trader must know.

The Israeli military is hunting a mole on Polymarket

Q4 $667M Net Loss: Coinbase Earnings Report Foreshadows Challenging 2026 for Crypto Industry?

BlackRock Buying UNI, What's the Catch?

Lost in Hong Kong

Gold Plunges Over 4%, Silver Crashes 11%, Stock Market Plummet Triggers Precious Metals Algorithmic Selling Pressure?

Coinbase and Solana make successive moves, Agent economy to become the next big narrative

Aave DAO Wins, But the Game Is Not Over

Coinbase Earnings Call, Latest Developments in Aave Tokenomics Debate, What's Trending in the Global Crypto Community Today?

ICE, the parent company of the NYSE, Goes All In: Index Futures Contracts and Sentiment Prediction Market Tool

On-Chain Options: The Crossroads of DeFi Miners and Traders

How WEEX and LALIGA Redefine Elite Performance

WEEX x LALIGA partnership: Where trading discipline meets football excellence. Discover how WEEX, official regional partner in Hong Kong & Taiwan, brings crypto and sports fans together through shared values of strategy, control, and long-term performance.

Best Crypto to Buy Now February 10 – XRP, Solana, Dogecoin

Key Takeaways XRP is set to revolutionize cross-border transactions, potentially reaching $5 by the end of Q2 with…

Kyle Samani Criticizes Hyperliquid in Explosive Post-Departure Market Commentary

Key Takeaways: Kyle Samani, former co-founder of Multicoin Capital, publicly criticizes Hyperliquid, labeling it a systemic risk. Samani’s…

Leading AI Claude Forecasts the Price of XRP, Cardano, and Ethereum by the End of 2026

Key Takeaways: XRP’s value is projected to reach $8 by 2026 due to major institutional adoption. Cardano (ADA)…

Bitcoin Price Prediction: Alarming New Research Cautions Millions in BTC at Risk of ‘Quantum Freeze’ – Are You Ready?

Key Takeaways Quantum Threat to Bitcoin: The rise of quantum computing presents a unique security challenge to Bitcoin,…

Who's at the CFTC Table? A Rebalancing of American Fintech Discourse

AI Trading vs Human Crypto Traders: $10,000 Live Trading Battle Results in Munich, Germany (WEEX Hackathon 2026)

Discover how AI trading outperformed human traders in WEEX's live Munich showdown. Learn 3 key strategies from the battle and why AI is changing crypto trading.

Elon Musk's X Money vs. Crypto's Synthetic Dollars: Who Wins the Future of Money?

How do Synthetic Dollars work? This guide explains their strategies, benefits over traditional stablecoins like USDT, and risks every crypto trader must know.