Key Market Intelligence on December 10th, how much did you miss out on?

Top News

4. DOYR Surges Over 290% Briefly Due to Binance Alpha Listing News

Trending Topics

Source: Overheard on CT (tg: @overheardonct), Kaito

Below is the Chinese translation of the original content:

【COINBASE】

Coinbase gained significant attention today due to its collaboration with PNC Bank. This partnership allows PNC's private clients to directly trade Bitcoin through their existing accounts, marking a significant milestone in institutional cryptocurrency adoption. This is the first such collaboration among major U.S. banks, highlighting Coinbase's role in driving the integration of cryptocurrency into the traditional banking system. Furthermore, discussions regarding Coinbase's strategic initiatives (such as re-entering the Indian market and participation in multiple crypto projects) have also raised its visibility.

【THEORIQ】

Today, the main discussions surrounding THEORIQ focused on the launch of the $THQ airdrop claim portal. This portal enables testnet users, Kaito Yappers, community ambassadors, and members to verify their eligibility and claim the airdrop. The process includes anti-whale measures and requires testnet users to mint a "proof of humanity" NFT. The airdrop registration period is from December 9 to December 14. In addition, THEORIQ has been included in Coinbase's roadmap, sparking high market attention and anticipation for its TGE.

【HYPERLIQUID】

HYPERLIQUID has received widespread attention today due to the launch of HyENA. HyENA is a new trading platform built on the Hyperliquid HIP-3 standard, offering innovative features such as margin staking for earnings. Discussions have also focused on Hyperliquid's recent auto-deleveraging event, which resulted in significant losses and sparked debates on improving the ADL mechanism. Additionally, the platform's potential in redefining perpetual contract trading and its market impact have been prominently mentioned.

【USDE】

Today, the main discussions around USDE have centered on the launch of HyENA. HyENA is a USDe margin perpetual contract DEX based on the Hyperliquid HIP-3 standard. It allows traders to earn rewards on USDe margin staking, converting idle margin into an efficient savings account. The platform, built by BasedOneX and supported by Ethena Labs, uses USDe as its core collateral. HyENA has introduced a new standard of on-chain transactions, enabling users to trade any asset 24/7 while earning rewards. Its innovative capital efficiency model and incentives (such as enhanced USDe margin APY and HyENA points) have garnered widespread attention. Discussions have emphasized HyENA's potential in redefining perpetual contract trading and gaining market share.

【KRAKEN】

Today, discussions surrounding KRAKEN have focused on its involvement in several key crypto events. KRAKEN is hosting a $FUN token sale in collaboration with Legion, and Sport.Fun is expanding its fantasy sports platform. Meanwhile, the launch of the ADI Chain mainnet and the listing of the $ADI token on KRAKEN, KuCoin, and Crypto.com have also gained attention, highlighting their role in the UAE's digital payment ecosystem. Additionally, strategic moves by KRAKEN (such as a $500 million pre-listing financing round and cooperation with the Deutsche Boerse) have been mentioned, showcasing its influence in bridging traditional finance and digital assets.

Featured Articles

1.《Trump Takes Over the Fed, Impact on Bitcoin in the Coming Months》

Tonight will see the most anticipated rate cut decision of the Fed this year. The market is overwhelmingly betting on a rate cut almost set in stone. However, what will truly determine the future trajectory of risk assets over the next few months is not another 25 basis points cut, but a more critical variable: whether the Fed will inject liquidity back into the market. So this time, Wall Street is not watching the rates but the balance sheet.

2.《a16z Predicts Four Major Trends Leading the Way in 2026》

Over the past year, the breakthroughs in AI have shifted from model capabilities to system capabilities: understanding long time series, maintaining consistency, performing complex tasks, and collaborating with other intelligent agents. The focus of industrial upgrade has also shifted from single-point innovation to redefining infrastructure, workflows, and user interaction methods. In the annual "Big Ideas 2026," a16z's four investment teams have provided key insights for 2026 from the dimensions of infrastructure, growth, healthcare, and the interactive world, respectively. Essentially, they collectively outline a trend: AI is no longer a tool but an environment, a system, an actor parallel to humans.

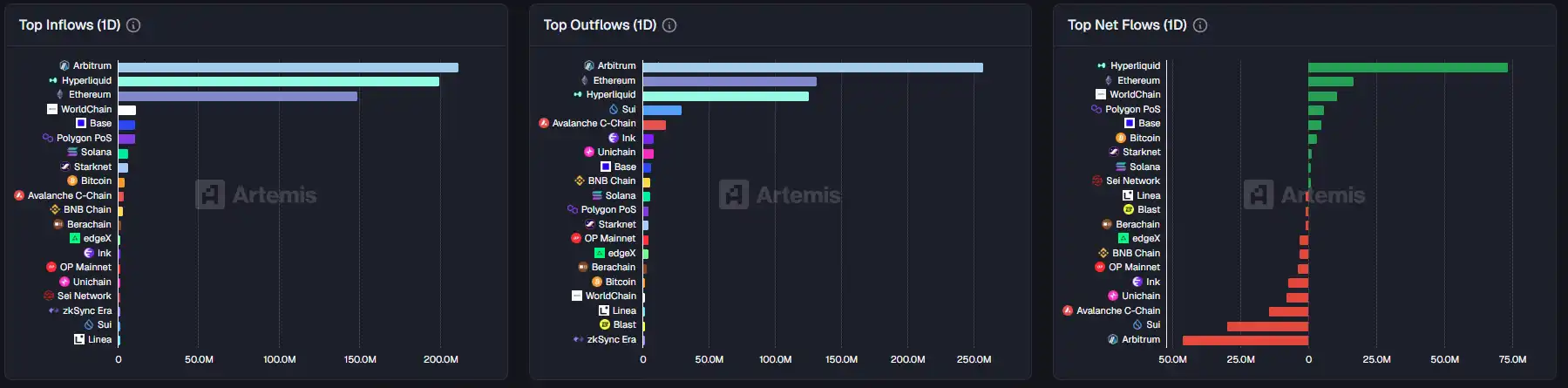

On-chain Data

Last week's on-chain fund flow on December 10th

You may also like

Stop Talking About Gold, Bitcoin Is Not a Safe Haven Asset

Aave Founder: What Is the Secret of the DeFi Lending Market?

The Trader's Playbook: 7 Market Cycle Lessons From LALIGA’s 90 Minutes

What do LALIGA matches teach about crypto markets? Learn how consolidation, breakouts, and late-cycle volatility shape disciplined trading decisions.

How Smart Money Tracker Survived Live AI Trading at WEEX AI Hackathon

Discover how WEEX AI Trading Hackathon tested strategies with real capital—no simulations. See how Smart Money Tracker survived flash crashes and leveraged 18x in live markets.

80% Win Rate to 40% Drawdown: An AI Trader's Brutal Recalibration at WEEX AI Wars

Dive into the technical blueprint of an AI trading system built on LLaMA reasoning and multi-agent execution. See how Quantum Quaser uses confidence thresholds & volatility filters at WEEX AI Wars, and learn the key to unlocking 95% win rate trades.

AI Trading Strategy Explained: How a Beginner Tiana Reached the WEEX AI Trading Hackathon Finals

Can AI trading really outperform human emotion? In this exclusive WEEX Hackathon finalist interview, discover how behavioral signal strategies, SOL trend setups, and disciplined AI execution secured a spot in the finals.

When AI Takes Over the 'Shopping Journey,' How Much Time Does PayPal Have Left?

Bloomberg: Aid Turkey Freeze $1 Billion Assets, Tether Remakes Compliance Boundary

Polymarket vs. Kalshi: The Full Meme War Timeline

Consensus Check: What Consensus Was Born at the 2026 First Conference?

Resigned in Less Than a Year of Taking Office, Why Did Yet Another Key Figure at the Ethereum Foundation Depart?

Russian-Ukrainian War Prediction Market Analysis Report

Ethereum Foundation Executive Director Resigns, Coinbase Rating Downgrade: What's the Overseas Crypto Community Talking About Today?

Who's at the CFTC Table? A Rebalancing of American Fintech Discourse

AI Trading vs Human Crypto Traders: $10,000 Live Trading Battle Results in Munich, Germany (WEEX Hackathon 2026)

Discover how AI trading outperformed human traders in WEEX's live Munich showdown. Learn 3 key strategies from the battle and why AI is changing crypto trading.

Elon Musk's X Money vs. Crypto's Synthetic Dollars: Who Wins the Future of Money?

How do Synthetic Dollars work? This guide explains their strategies, benefits over traditional stablecoins like USDT, and risks every crypto trader must know.

The Israeli military is hunting a mole on Polymarket

Q4 $667M Net Loss: Coinbase Earnings Report Foreshadows Challenging 2026 for Crypto Industry?

Stop Talking About Gold, Bitcoin Is Not a Safe Haven Asset

Aave Founder: What Is the Secret of the DeFi Lending Market?

The Trader's Playbook: 7 Market Cycle Lessons From LALIGA’s 90 Minutes

What do LALIGA matches teach about crypto markets? Learn how consolidation, breakouts, and late-cycle volatility shape disciplined trading decisions.

How Smart Money Tracker Survived Live AI Trading at WEEX AI Hackathon

Discover how WEEX AI Trading Hackathon tested strategies with real capital—no simulations. See how Smart Money Tracker survived flash crashes and leveraged 18x in live markets.

80% Win Rate to 40% Drawdown: An AI Trader's Brutal Recalibration at WEEX AI Wars

Dive into the technical blueprint of an AI trading system built on LLaMA reasoning and multi-agent execution. See how Quantum Quaser uses confidence thresholds & volatility filters at WEEX AI Wars, and learn the key to unlocking 95% win rate trades.

AI Trading Strategy Explained: How a Beginner Tiana Reached the WEEX AI Trading Hackathon Finals

Can AI trading really outperform human emotion? In this exclusive WEEX Hackathon finalist interview, discover how behavioral signal strategies, SOL trend setups, and disciplined AI execution secured a spot in the finals.