On-Chain Data Academy (Part 3): Have the Whales Profiting from Bottom Feeding Cashed Out?

Original Article Title: "On-chain Data School (Part 3): Have the Bottom-Fishing Whales Taken Profit?"

Original Article Author: Mr. Berg, On-chain Data Analyst

This article is the 3rd part of the On-chain Data School series, with a total of 10 parts. It takes you step by step through understanding on-chain data analysis. Interested readers are welcome to follow this series of articles.

Related Reading: "On-chain Data School (Part 2): The Ever-profitable Hodlers, What Is Their BTC Acquisition Cost?"

TLDR

- This article will introduce the on-chain metric Realized Profit

- Realized Profit shows the daily amount of profit-taking in the market

- Massive Realized Profit is usually only caused by low-cost chip holders

- Tops are usually accompanied by massive Realized Profit

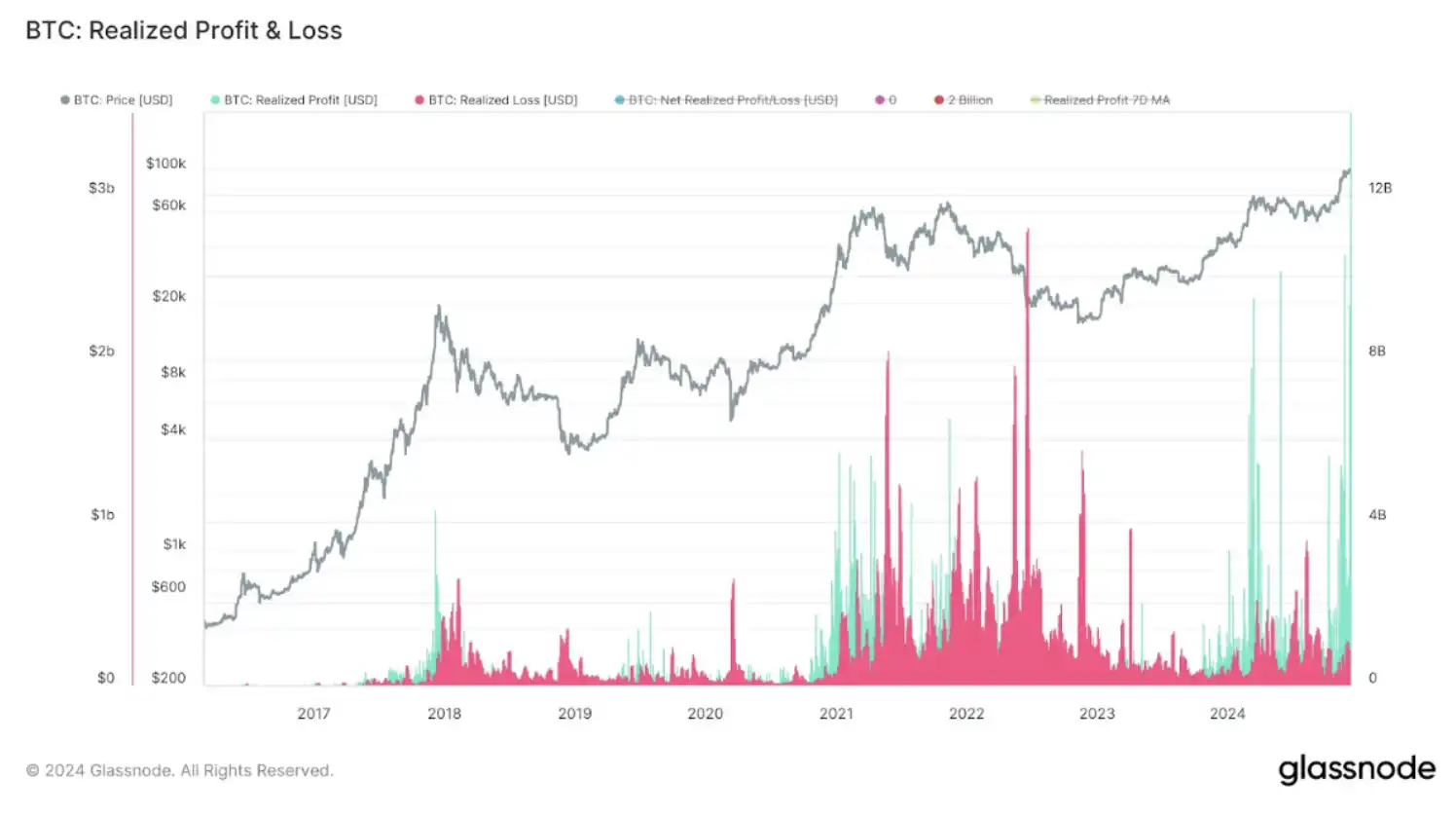

Realized Profit & Realized Loss Overview

Realized Profit, translated as "已实现利润" in Chinese, is based on the price of each BTC at the time of its last transfer and the price at the time of the previous transfer, calculating how many BTC are profitably settled each day. By summing up the total profit from these settled BTC, the daily Realized Profit can be obtained.

Of course, if the price at the time of the last transfer is lower than the price at the time of the previous transfer, it will be recorded as Realized Loss.

Realized Profit & Realized Loss Chart

Massive Realized Profit is Usually Only Caused by Low-Cost Chip Holders

As shown in the diagram below: Due to the high cost basis of holders, their profit margin is not large, so when they sell, the **Realized Profit** they can generate is not high.

Therefore, when we see a significant amount of Realized Profit, it usually means that holders with a low cost basis are selling BTC.

Realized Profit Calculation Diagram

Tops are usually accompanied by significant Realized Profit

When a large number of holders with a low cost basis sell their BTC, we will see clustered high-volume realized profits on the chart.

At this point, since the remaining participants in the market are high cost basis acquirers, and the market price is close to their cost basis, any slight shift in sentiment is more likely to trigger panic selling from them, causing a cascading price drop, forming a top.

Tops are usually accompanied by significant Realized Profit

Conclusion

The above is all the content of On-Chain Data School (III). For readers interested in delving deeper into on-chain data analysis, remember to keep track of this series of articles!

If you would like to see more analysis and educational content on on-chain data, feel free to follow my Twitter handle (X)!

I hope this article has been helpful to you. Thank you for reading.

You may also like

Who's at the CFTC Table? A Rebalancing of American Fintech Discourse

AI Trading vs Human Crypto Traders: $10,000 Live Trading Battle Results in Munich, Germany (WEEX Hackathon 2026)

Discover how AI trading outperformed human traders in WEEX's live Munich showdown. Learn 3 key strategies from the battle and why AI is changing crypto trading.

Elon Musk's X Money vs. Crypto's Synthetic Dollars: Who Wins the Future of Money?

How do Synthetic Dollars work? This guide explains their strategies, benefits over traditional stablecoins like USDT, and risks every crypto trader must know.

The Israeli military is hunting a mole on Polymarket

Q4 $667M Net Loss: Coinbase Earnings Report Foreshadows Challenging 2026 for Crypto Industry?

BlackRock Buying UNI, What's the Catch?

Lost in Hong Kong

Gold Plunges Over 4%, Silver Crashes 11%, Stock Market Plummet Triggers Precious Metals Algorithmic Selling Pressure?

Coinbase and Solana make successive moves, Agent economy to become the next big narrative

Aave DAO Wins, But the Game Is Not Over

Coinbase Earnings Call, Latest Developments in Aave Tokenomics Debate, What's Trending in the Global Crypto Community Today?

ICE, the parent company of the NYSE, Goes All In: Index Futures Contracts and Sentiment Prediction Market Tool

On-Chain Options: The Crossroads of DeFi Miners and Traders

How WEEX and LALIGA Redefine Elite Performance

WEEX x LALIGA partnership: Where trading discipline meets football excellence. Discover how WEEX, official regional partner in Hong Kong & Taiwan, brings crypto and sports fans together through shared values of strategy, control, and long-term performance.

Best Crypto to Buy Now February 10 – XRP, Solana, Dogecoin

Key Takeaways XRP is set to revolutionize cross-border transactions, potentially reaching $5 by the end of Q2 with…

Kyle Samani Criticizes Hyperliquid in Explosive Post-Departure Market Commentary

Key Takeaways: Kyle Samani, former co-founder of Multicoin Capital, publicly criticizes Hyperliquid, labeling it a systemic risk. Samani’s…

Leading AI Claude Forecasts the Price of XRP, Cardano, and Ethereum by the End of 2026

Key Takeaways: XRP’s value is projected to reach $8 by 2026 due to major institutional adoption. Cardano (ADA)…

Bitcoin Price Prediction: Alarming New Research Cautions Millions in BTC at Risk of ‘Quantum Freeze’ – Are You Ready?

Key Takeaways Quantum Threat to Bitcoin: The rise of quantum computing presents a unique security challenge to Bitcoin,…

Who's at the CFTC Table? A Rebalancing of American Fintech Discourse

AI Trading vs Human Crypto Traders: $10,000 Live Trading Battle Results in Munich, Germany (WEEX Hackathon 2026)

Discover how AI trading outperformed human traders in WEEX's live Munich showdown. Learn 3 key strategies from the battle and why AI is changing crypto trading.

Elon Musk's X Money vs. Crypto's Synthetic Dollars: Who Wins the Future of Money?

How do Synthetic Dollars work? This guide explains their strategies, benefits over traditional stablecoins like USDT, and risks every crypto trader must know.